Best Ways To Turn Money Into Wealth

If you want to join the ranks of the wealthy, it’s time to start thinking about your money differently. Instead of just spending it on whatever you want, start thinking about how you can use it to make more money. Here are a few ideas to get you started:

1. Invest in real estate. This is one of the most commonly used methods for building wealth, and for good reason. When you invest in property, you’re not only getting a physical asset that can appreciate in value over time, but you’re also getting the potential for rental income and capital gains when you sell.

2. Start a business. Another great way to turn your money into wealth is to start your own business. Not only will you get to be your own boss and have full control over your income, but if your business is successful, it can make you a lot of money down the road.

3. Invest in stocks and mutual funds. Another popular method for building wealth is investing in the stock market. While there is always some risk involved, if you pick the right investments, you can make a lot of money over time as the value of your assets grows.

4. Save for retirement. One of the smartest things you can do with your money is save for retirement. By investing in a 401k or IRA, you’ll be able to grow your nest egg tax-deferred or tax-free, which means more money in your pocket later on down the road.

5. Use debt wisely. While too much debt can be damaging, using debt wisely can actually help you build wealth. For example, taking out a loan to invest in a rental property or a business can help you leverage your money and make more money down the road than if you had just invested your own cash outright.

Building wealth takes time and patience, but it’s definitely possible if you’re smart about it.

Why Personal Finance Turning Money Into Wealth Is Necessary?

One of the keystones to building wealth is effective management of personal finances. This means setting goals and putting a plan in place to achieve those goals. It also involves learning how to live below your means, investing money wisely, and maintaining good credit.

Best personal finance turning money into wealth is necessary because it provides the framework for making sound financial decisions. It helps you understand your rights and responsibilities as a consumer, know what products and services are available to you, and make informed choices about spending and saving. Additionally, best personal finance turning money into wealth gives you the tools you need to manage debt effectively and make smart investment choices.

Our Top Picks For Best Personal Finance Turning Money Into Wealth

Best Personal Finance Turning Money Into Wealth Guidance

Personal Finance (The Pearson Series in Finance)

Personal finance is the process of planning and managing one’s financial activities with the goal of achieving financial security. It includes creating a budget, saving money, making sound investment decisions, and reducing debt.

Creating a budget is the first step to take when managing your finances. This will help you track your spending and see where you can cut back. You should also save money each month to build up an emergency fund in case of unexpected expenses.

Making wise investment choices is another key aspect of personal finance. Investing your money can help you reach your financial goals quicker. However, it’s important to do your research and only invest in what you understand.

Lastly, reducing debt is crucial for financial success. High interest debt can quickly become unmanageable, so it’s important to pay it off as soon as possible. Try to focus on paying off your highest interest debt first and then move on to your other debts.

By following these steps, you can take control of your finances and achieve financial security.

Common Questions on Personal Finance (The Pearson Series in Finance)

• What is the role of the Securities and Exchange Commission (SEC)?The SEC is a government agency that regulates the securities industry.

• What are the three types of financial statements?

The three types of financial statements are the balance sheet, income statement, and statement of cash flows.

• What is the difference between accounting and finance?

Accounting is the process of recording, classifying, and summarizing financial transactions to provide information that is useful in making business decisions. Finance is the process of making decisions about how to allocate resources in order to achieve financial goals.

• What are the four types of financial institutions?

The four types of financial institutions are banks, insurance companies, investment companies, and pension funds.

• What is the role of the Federal Reserve?

The Federal Reserve is the central bank of the United States and is responsible for monetary policy.

Why We Like This

1. The book provides an overview of personal finance topics including budgeting, saving, and investing.

2. The book offers advice on how to manage your finances and make sound financial decisions.

3. The book covers a range of topics including credit, debt, and retirement planning.

4. The book provides practical tips and strategies for managing your money.

5. The book is written in an easy to understand and practical style.

Additional Product Information

| Height | 11 Inches |

| Length | 8.6 Inches |

| Weight | 3.15040572398 Pounds |

Principles for Dealing with the Changing World Order: Why Nations Succeed and Fail

The world is constantly changing and evolving, and with that comes a shifting power dynamic. As different nations rise and fall in prominence, it’s important to understand the principles that lead to their success or failure. Here are four key factors:

1. A nation’s ability to adapt to change. The world is always changing, and those who can change with it are more likely to succeed. A nation that is inflexible and resistant to change is more likely to fall behind.

2. A nation’s economic stability. A nation that is economically stable is more likely to maintain its power and influence. A nation that is unstable or in decline is more likely to see its power diminish.

3. A nation’s military strength. A nation with a strong military is more likely to be respected and feared by its competitors. A nation that is weak militarily is more likely to be ignored or taken advantage of.

4. A nation’s political stability. A nation with a stable political system is more likely to be respected and seen as a leader. A nation with chaotic or dysfunctional politics is more likely to be seen as weak and unimportant.

Common Questions on Principles for Dealing with the Changing World Order: Why Nations Succeed and Fail

• What are the four principles for dealing with the changing world order?The four principles for dealing with the changing world order are (1)Attitude, (2) Mindset, (3) Beliefs, and (4) Actions.

• What is the difference between a country that succeeds and one that fails?

The difference between a country that succeeds and one that fails is that successful countries have a positive attitude, proper mindset, right beliefs, and take effective actions. On the other hand, failed countries usually have a negative attitude, improper mindset, wrong beliefs, and take ineffective actions.

• Can a country improve its chances of success by following these principles?

Yes, a country can improve its chances of success by following these principles.

Why We Like This

• 1. A comprehensive guide to understanding the changing world order and the factors that influence a nation’s success or failure• 2. An analysis of over 200 years of data on the rise and fall of nations• 3. A clear and concise framework for understanding the complex geopolitical landscape• 4. Insightful case studies on a variety of nations, including the United States, China, and Russia• 5. A thought provoking look at the future of the world order and the challenges and opportunities that lie ahead

USAGA Head Massager Scalp Massager 20 Fingers Head Scratcher for Head Body Relaxing

When it comes to relaxation, there’s nothing quite like a good head massage. And with the USAGA Head Massager, you can enjoy the benefits of a professional massage in the comfort of your own home. This scalp massager features 20 flexible fingers that provide a thorough, relaxing massage, while the adjustable size means it can be easily customized to fit any head size. The durable construction and easy-to-clean design make it a great choice for anyone looking for an effective and easy-to-use massager. So if you’re looking for a way to relax and unwind, the USAGA Head Massager is a great option.

Common Questions on USAGA Head Massager Scalp Massager 20 Fingers Head Scratcher for Head Body Relaxing

• How does the USAGA Head Massager Scalp Massager work?The USAGA Head Massager Scalp Massager uses 20 fingers to massage the scalp and head, providing a relaxing and invigorating experience.

• How do I use the USAGA Head Massager Scalp Massager?

To use the USAGA Head Massager Scalp Massager, simply place it on the scalp and massage in a circular motion. Repeat this process five times for best results.

• What are the benefits of using the USAGA Head Massager Scalp Massager?

The USAGA Head Massager Scalp Massager can help to improve circulation, relieve tension headaches, and relax the muscles in the head and neck.

• How often should I use the USAGA Head Massager Scalp Massager?

For best results, it is recommended to use the USAGA Head Massager Scalp Massager at least once per day.

Why We Like This

• 1.The USAGA Head Massager Scalp Massager 20 Fingers Head Scratcher for Head Body Relaxing is fully relaxing and perfect for people with anxiety and sleep problems.• 2.This product is easy to function and only requires the user to slowly move it back and forward on their scalp, neck, and shoulders for a new and different experience.• 3.The USAGA Head Massager Scalp Massager 20 Fingers Head Scratcher for Head Body Relaxing is durable and easy to clean due to it being made of metal.• 4.This product is adjustable to the size needed as the scalp massager prongs are made of high elastic spring.• 5.If the user is not satisfied with the product, they can contact customer service for a hassle free refund.

Additional Product Information

| Color | Silvery |

| Height | 5.2 Inches |

| Length | 10.23 Inches |

| Weight | 0.110231131 Pounds |

Inspirational Motivational Wall Art & Decor – Entrepreneur Positive Quotes Poster Prints 8×10 – Home Office – Classroom Decor – Success Sayings – Encouragement Gifts for Men, Women – Encouraging Motto

Looking for some inspiration or just a little pick-me-up? Check out our collection of inspirational wall art and decor. These uplifting prints and posters are perfect for hanging in your office, home or classroom. With motivational quotes and sayings, they make great encouragement gifts for men, women and kids. So many styles to choose from!

Common Questions on Inspirational Motivational Wall Art & Decor – Entrepreneur Positive Quotes Poster Prints 8×10 – Home Office – Classroom Decor – Success Sayings – Encouragement Gifts for Men, Women – Encouraging Motto

• What are the dimensions of the product?8×10 inches

• What is the product made of?

Poster print on high quality paper

• How is the product made?

Printed in the USA

• How many products are in a set?

1 product in a set

Why We Like This

• • 8×10 UNFRAMED PRINTS NOT Canvas or Tin Sign• UNIQUE WALL ART DECOR• PERFECT PRESENT FOR EVERY OCCASION• SO MANY STYLES!• SAVE ON MULTIPLE POSTERS, PRINTS, PHOTOS, PICTURES

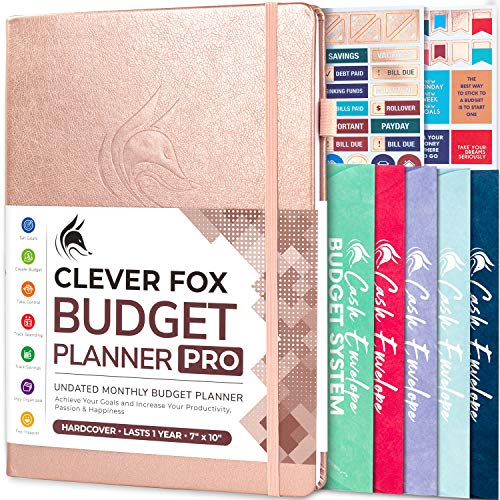

Clever Fox Budget Planner Pro – Financial Organizer + Cash Envelope Budget System. Monthly Finance Journal, Expense Tracker & Personal Account Book. Undated – Start Anytime. (7”x10”) – Rose Gold

If you’re looking for a budget planner that will help you take control of your finances and reach your financial goals, the Clever Fox Budget Planner Pro is the perfect tool for you. This budget book with cash envelopes comes with 12 monthly sections, each with a calendar spread, monthly budget, review, expense tracker, and dot-grid page for notes. There is also a section for tracking savings, debt, and Christmas spending, as well as two annual summary pages. The budget notebook is made from high-quality leatherette hardcover and thick no-bleed 120gsm paper, and the budget envelopes are made of a unique tear and water-resistant material, making them durable and reusable. The Clever Fox Budget Planner Pro is guaranteed to keep your finances organized or your money back!

Common Questions on Clever Fox Budget Planner Pro – Financial Organizer + Cash Envelope Budget System. Monthly Finance Journal, Expense Tracker & Personal Account Book. Undated – Start Anytime. (7”x10”) – Rose Gold

• How much money should you save each month?The amount you save each month depends on your income, debts, and expenses. However, most financial experts recommend saving at least 10% of your income.

• What are some creative ways to save money?

One creative way to save money is to create a budget and track your spending. This will help you see where your money is going and where you can cut back. Other creative ways to save money include using coupons, shopping at thrift stores, and cooking at home.

• What are some tips for sticking to a budget?

Some tips for sticking to a budget include setting realistic goals, tracking your progress, and being willing to make sacrifices. It is also important to have a plan for what you will do if you overspend or have unexpected expenses.

Why We Like This

• 1. Takes control of finances• 2. One tool for reaching financial objectives• 3. Smart and practical personal finance• 4. Premium quality and bonuses• 5. Guaranteed to keep finance organized

Additional Product Information

| Color | Rose Gold |

Benefits of Personal Finance Turning Money Into Wealth

Most people will never become wealthy simply because they don’t understand the concept of turning money into wealth. They think that making a lot of money is the same as being wealthy, but it’s not. turns your money into an asset that makes more money for you without you having to work for it. This is how the rich get richer and why most people will never become wealthy.

Here are some benefits of turning your money into wealth:

1) You can live a better life – When you have more assets working for you, you can afford to live a better life. You can buy nicer things, take more vacations, and overall enjoy your life more when you don’t have to worry about where your next paycheck is coming from.

2) You can help others – When you’re financially free,you can help others achieve their financial goals too.You’ll be able to retire earlier – One of the best benefits of having wealth is that if done correctly,you won’t have to work forever! You’ll be able travel or do whatever else it is in retirement without worrying about running out of Money .

Buying Guide for Best Personal Finance Turning Money Into Wealth

When it comes to turning money into wealth, there are a lot of different strategies and products out there. So, how do you know which ones are the best for you? Well, that’s where a personal finance buying guide comes in handy!

A personal finance buying guide can help you sort through all of the options and figure out which products and strategies are best for your unique situation. Here are a few things to look for in a good personal finance buying guide:

1. First, make sure the guide is comprehensive. It should cover all aspects of personal finance, from investing to saving to budgeting.

2. Second, look for a guide that is easy to understand and follow. The last thing you want is something that’s full of financial jargon that you don’t understand!

3. Third, look for a guide that gives concrete advice. Remember, this is YOUR money we’re talking about here – so you want to be sure that the advice in the guide will actually work for YOU.

4. Finally, find a personal finance buying guide that is regularly updated with new information. The world of personal finance changes pretty quickly, so you want to be sure that your guide is keeping up with the latest changes!

Frequently Asked Question

How can I turn my money into wealth?

There is no one answer to this question as there are many paths to wealth. Some people create wealth by investing in stocks, real estate or other assets, while others build businesses or create products that generate income. No matter what route you take, there is usually a lot of hard work, dedication and luck involved in becoming wealthy.

What are the best strategies for personal finance?

Some general strategies that can help improve personal finances include creating a budget, reducing expenses, increasing income, paying off debt, and investing in long-term savings.

How can I save money and invest wisely?

Some ways to save money and invest wisely are to create a budget and make sure to stick to it, invest in a mix of different types of investments, and start saving early.

What are the biggest mistakes people make with their finances?

There are many mistakes that people make with their finances, but some of the biggest include: not saving for retirement, not having an emergency fund, carrying too much debt, and spending more money than they earn.

How can I become financially independent?

Some basic tips for achieving financial independence include creating and following a budget, investing in stocks, real estate, or other assets, and saving as much money as possible. Additionally, financial independence can be achieved by earning a high income, living below your means, and having little to no debt.

Conclusion

Making wise decisions with your money is the key to turning it into wealth. By investing in our product, you can be sure that you are making a smart choice that will help you reach your financial goals. We offer a risk-free investment opportunity that comes with a guarantee of returns, so you have nothing to lose and everything to gain. With our help, you can achieve the wealth you’ve always dreamed of. Contact us today to learn more about how we can help you make your money work for you.