Accounting Best Horngren’s Financial And Managerial Accounting

Why Horngren’s Financial And Managerial Is Necessary?

There are a number of reasons why best horngren’s financial and managerial is necessary. First, best horngren’s financial and managerial provides critical information that businesses need to make sound financial decisions. Without this information, businesses would be unable to make informed decisions about where to allocate their resources. Second, best horngren’s financial and managerial helps businesses track their progress over time. This information is essential for businesses to gauge whether they are on track to meet their goals.

Our Top Picks For Best Horngren’s Financial And Managerial

Best Horngren’s Financial And Managerial Guidance

Horngren’s Financial & Managerial Accounting / Edition 6 Funny Metal Novelty Sign ,8x12in Painting Tin Sign Vintage Wall Decor for Cafe Bar Pub Home Beer Decoration Crafts Retro Vintage Sign

According to financial and managerial accounting textbook Horngren’s Financial & Managerial Accounting / Edition 6, accounting is defined as “the process of recording, classifying, and summarizing economic events to provide information that is useful in making business decisions.”

The goal of accounting is to provide information that is useful in making business decisions. This means that accounting must be relevant, accurate, and timely. Relevance means that the information must be useful to the decision maker. Accuracy means that the information must be free from error. Timeliness means that the information must be available when it is needed.

The main users of accounting information are managers, investors, and creditors. Managers use accounting information to make decisions about how to run the business. Investors use accounting information to make decisions about whether or not to invest in a company. Creditors use accounting information to make decisions about whether or not to lend money to a company.

Some of the most important concepts in accounting are accruals, deferrals, and matching. The accrual concept says that income should be recognised when it is earned, regardless of when the cash is received. The deferral concept says that expenses should be recognised when they are incurred, regardless of when the cash

Common Questions on Horngren’s Financial & Managerial Accounting / Edition 6 Funny Metal Novelty Sign ,8x12in Painting Tin Sign Vintage Wall Decor for Cafe Bar Pub Home Beer Decoration Crafts Retro Vintage Sign

• What is the current ratio if current assets are $1,000 and current liabilities are $500?The current ratio would be 2:1 if current assets are $1,000 and current liabilities are $500.

Why We Like This

• 1. Made of high quality metal, durable and long lasting.

• 2. Comes with pre drilled holes for easy hanging.

• 3. Rolled and hemmed edges for safe handling.

• 4. Perfect for decorating bars, kitchens and homes.

• 5. Suitable for indoor or outdoor use.

Additional Product Information

| Color | JIANHAI24417 |

| Height | 0.1 Inches |

| Length | 12 Inches |

Horngren’s Financial & Managerial Accounting: The Financial Chapters

Horngren’s Financial & Managerial Accounting: The Financial Chapters is a detailed and professional explanation of financial accounting. It covers topics such as financial statements, bookkeeping, and cost accounting. The book is well-written and easy to understand.

Common Questions on Horngren’s Financial & Managerial Accounting: The Financial Chapters

• How does Horngren’s Financial & Managerial Accounting: The Financial Chapters finding the ending balance in the Cash Flow Statement?Horngren’s Financial & Managerial Accounting: The Financial Chapters uses the statement of cash flows to find the ending balance in the cash flow statement. The statement of cash flows is a summary of a company’s inflows and outflows of cash.

Why We Like This

1. Thorough coverage of essential financial accounting topics

2. Lucid explanations of key concepts

3. Detailed examples and illustrations

4. Self test questions and answers for reinforcement

5. Real world case studies for added context

Additional Product Information

| Height | 10.82675 Inches |

| Length | 9.0551 Inches |

| Weight | 4.0234362815 Pounds |

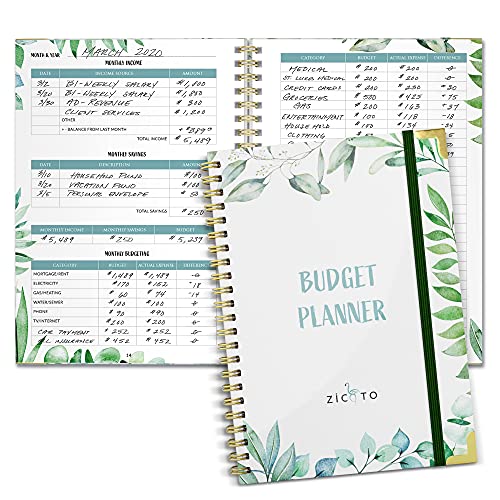

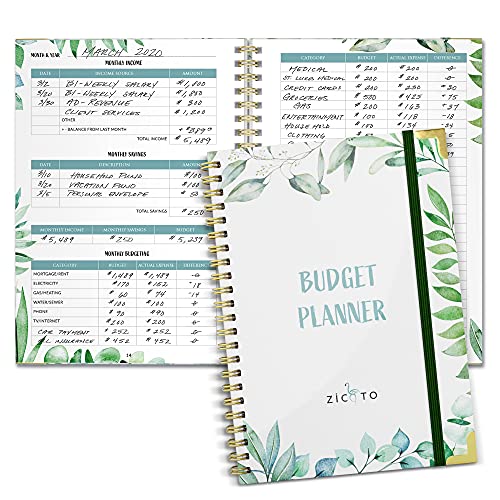

Simplified Monthly Budget Planner – Easy Use 12 Month Financial Organizer with Expense Tracker Notebook – The 2022-2023 Monthly Money Budgeting Book That Manages Your Finances Effectively

Setting and achieving financial goals can be a difficult task. For many people, it can be difficult to even know where to start when it comes to developing a budget and creating long-term financial stability. If this is something you’re struggling with, don’t worry – you’re not alone.

The good news is that there are tools available to help you get on the right track. One of these tools is the Simplified Monthly Budget Planner from ZICOTO. This budget planner is designed to help you manage your finances effectively and set new financial standards in your life.

With the Simplified Monthly Budget Planner, you can track your income, savings, debts, and expenses so that you can see where your money is going each month. This budget planner is undated, so you can start using it at any time. It’s also small enough to fit in your purse or backpack, making it easy to take with you wherever you go.

The Simplified Monthly Budget Planner includes 2 sticker sheets for personalization, instructions on how to use the budget planner, and motivational quotes on each review page to keep you focused on your goals. These features, combined with the budget planner’s sleek and stylish design, make it a great tool for anyone

Common Questions on Simplified Monthly Budget Planner – Easy Use 12 Month Financial Organizer with Expense Tracker Notebook – The 2022-2023 Monthly Money Budgeting Book That Manages Your Finances Effectively

• What is the title of the book?Simplified Monthly Budget Planner – Easy Use 12 Month Financial Organizer with Expense Tracker Notebook – The 2022-2023 Monthly Money Budgeting Book That Manages Your Finances Effectively

• Who is the author of the book?

The author is unknown.

• What is the book about?

The book is a budget planner that helps manage finances effectively. It features monthly expense tracking and budgeting tips.

Why We Like This

• 1. Hardcover design for durability and easy budget planning

• 2. Elastic band closure to keep your place

• 3. Stickers, How To’s & Motivation included

• 4. Perfect size for any bag

• 5. 12 Month financial planner

Additional Product Information

| Color | Green |

| Height | 8.35 Inches |

| Length | 5.51 Inches |

Horngren’s Financial & Managerial Accounting (5th Edition)

Horngren’s Financial & Managerial Accounting (5th Edition), by D. Schroeder, J. Catanzaro, and R. H. Strawser, has been designed to help readers become more effective communicators, better problem solvers, and more critical thinkers. The text uses a clear and concise writing style, making it easy for readers to follow along and understand the material. In addition, the 5th edition features updated content and examples to keep readers up-to-date with the latest accounting developments.

Common Questions on Horngren’s Financial & Managerial Accounting (5th Edition)

• What is the main focus of managerial accounting?The main focus of managerial accounting is to provide information that will help managers make decisions about running their business. This information can include financial and non-financial data.

• How does managerial accounting differ from financial accounting?

Managerial accounting focuses on providing information to managers to help them make decisions, while financial accounting focuses on providing information to shareholders and other external users.

• What types of information do managerial accountants use?

Managerial accountants use both financial and non-financial data to prepare reports. Financial data includes things like balance sheets and income statements, while non-financial data includes things like customer surveys and production data.

• How can managerial accounting be used to make decisions?

Managerial accounting can be used to make decisions about pricing, production, and investment. Additionally, managerial accounting can be used to make decisions about where to allocate resources within a company.

• What are some of the benefits of using managerial accounting?

Some of the benefits of using managerial accounting include gaining a better understanding of your costs, being able to make more informed decisions, and being able to better control your finances. Additionally, managerial

Why We Like This

• 1. The fifth edition of Horngren’s Financial & Managerial Accounting offers students a clear introduction to fundamental accounting concepts.

• 2. The text provides a strong foundation in accounting principles and real world applications.

• 3. The book’s clear and concise writing style makes complex topics easy to understand.

• 4. The text includes numerous examples and practice problems to help students master key concepts.

• 5. The new edition features updated coverage of recent accounting developments and changes in the business world.

Additional Product Information

| Height | 10.9 Inches |

| Length | 9.4 Inches |

| Weight | 7.3634395508 Pounds |

Budget Planner & Monthly Bill Organizer Book – (Non-Dated) Budget Book and Expense Tracker Notebook– Financial Planner Bundled with Cash Envelopes – Budget Journal with Pockets for Money

In today’s world, it’s more important than ever to keep track of your finances and ensure that your spending is under control. That’s why we created the Budget Planner & Monthly Bill Organizer Book – a stylish and practical way to keep track of your budget and expenses.

This budget book includes 1 Annual Expenses Budget Page, Title Pages Per Month with Pockets for Receipts and Bills, 10 Pages PER MONTH of Financial Planning Tools, 2 Blank Notes Pages Per Month, 1 Christmas Section with Pockets for Receipts and Bills, 4 Pages of Christmas or Holiday Expense Tracker Pages, 1 Useful Information Page and 2021 – 2022 – 2023 Yearly Calendars.

Our unique budget book also includes a specialized section for tracking Christmas and holiday spending. This way, you can get a head start on budgeting for the season and ensure that your holiday spending is under control.

The Budget Planner & Monthly Bill Organizer Book is perfect for keeping track of your finances and ensuring that your spending is under control. With its stylish design and practical features, this budget book is a must-have for anyone looking to stay on top of their finances.

Common Questions on Budget Planner & Monthly Bill Organizer Book – (Non-Dated) Budget Book and Expense Tracker Notebook– Financial Planner Bundled with Cash Envelopes – Budget Journal with Pockets for Money

• What is the price of the Budget Planner & Monthly Bill Organizer Book – (Non-Dated) Budget Book and Expense Tracker Notebook– Financial Planner Bundled with Cash Envelopes – Budget Journal with Pockets for Money?The price of the Budget Planner & Monthly Bill Organizer Book – (Non-Dated) Budget Book and Expense Tracker Notebook– Financial Planner Bundled with Cash Envelopes – Budget Journal with Pockets for Money is $24.99.

• What are the dimensions of the Budget Planner & Monthly Bill Organizer Book – (Non-Dated) Budget Book and Expense Tracker Notebook– Financial Planner Bundled with Cash Envelopes – Budget Journal with Pockets for Money?

The dimensions of the Budget Planner & Monthly Bill Organizer Book – (Non-Dated) Budget Book and Expense Tracker Notebook– Financial Planner Bundled with Cash Envelopes – Budget Journal with Pockets for Money are 9 x 6 x 1 inches.

• What is the shipping weight of the Budget Planner & Monthly Bill Organizer Book – (Non-Dated) Budget Book and Expense Tracker Notebook– Financial Plan

Why We Like This

• 1. Comes with 3 cash envelopes

• 2. Helps you track and organize your spending to control your debt

• 3. Includes an annual expenses budget page

• 4. Has a special section to track Christmas and holiday spending

• 5. Fashionable and perfect portable size

Additional Product Information

| Color | BOOK + ENVELOPES |

| Height | 1 Inches |

| Length | 8.25 Inches |

Benefits of Horngren’s Financial And Managerial

The most common financial statements are the income statement, balance sheet and cash flow statement. The income statement shows a company’s revenue and expenses over a period of time, while the balance sheet shows a company’s assets, liabilities and shareholders’ equity at a particular point in time. The cash flow statement tracks how much cash is coming in and going out of the business.

managerial accounting information is used by managers within organizations to make decisions about how to allocate resources and plan for the future. This type of accounting provides detailed financial information that is not typically reported in financial accounting.

Some common examples of managerial accounting reports include budgets, variance analysis, cost volume profit analysis (CVP), process costing and activity based costing (ABC).

Buying Guide for Best Horngren’s Financial And Managerial

When looking for the best financial and managerial accounting text, there are a few things to consider. First, make sure the textbook covers the essential topics in both financial and managerial accounting. Next, look for a text that is clear and concise, with easy-to-understand explanations of key concepts. Finally, choose a textbook that incorporates real-world examples to illustrate core ideas.

Frequently Asked Question

How does Horngren’s Financial and Managerial Accounting help students learn essential accounting concepts?

Horngren’s Financial and Managerial Accounting helps students learn essential accounting concepts by providing them with a clear and concise overview of the most important topics in accounting. The book covers all of the major topics in accounting, including financial statements, managerial accounting, cost accounting, and auditing. The book is written in a clear and easy-to-understand style, making it an excellent resource for students who want to learn accounting.

How does Horngren’s Financial and Managerial Accounting provide a strong foundation for students pursuing a career in accounting?

Horngren’s Financial and Managerial Accounting provides a strong foundation for students pursuing a career in accounting by teaching them the basic concepts and skills necessary to be successful in the field. The book covers a wide range of topics, from financial statements and ratios to cost accounting and managerial decision-making. By giving students a comprehensive overview of accounting, Horngren’s Financial and Managerial Accounting provides them with the strong foundation they need to pursue a career in this field.

What accounting topics are covered in Horngren’s Financial and Managerial Accounting?

In Horngren’s Financial and Managerial Accounting, the topics of financial accounting and managerial accounting are covered. Financial accounting topics include financial statements, bookkeeping, and accounting principles. Managerial accounting topics include budgeting, cost accounting, and performance measurement.

How is Horngren’s Financial and Managerial Accounting organized to help students learn effectively?

Horngren’s Financial and Managerial Accounting is organized around key financial statements, providing students with a strong foundation in accounting principles and real-world applications. The text’s clear presentation and step-by-step explanations help students grasp complex concepts and build strong problem-solving skills.

What resources are available to students using Horngren’s Financial and Managerial Accounting?

There are many resources available to students using Horngren’s Financial and Managerial Accounting. Some of these resources include the textbook, online resources, and instructor resources.

Conclusion

The best way to ensure that your finances are in order is to utilize Horngren’s Financial and Managerial Accounting. This software is designed to help you stay on track with your budget and will also provide you with analysis tools so that you can see where your money is going. In addition, Horngren’s Financial and Managerial Accounting offers a wide range of features that can be customized to fit your specific needs. With this software, you will be able to take control of your finances and get a better understanding of where your money is going.